Guaranteed Rate made two significant executive appointments, the Chicago-based mortgage lender announced on Monday. CJ Rose was promoted to the role of executive vice president of growth and acquisition, while Chris Hutchens was hired as producing area manager for North Carolina and senior vice president of mortgage lending. Rose will

Read more

Three of the biggest topics in housing right now are mortgage rate movements tied to Federal Reserve policymaking, the day-to-day moves in key housing data and forward-looking trends for the housing market. This week at The Gathering by HousingWire in Scottsdale, Arizona, these topics were tackled in separate sessions by

Read more

Real estate coach Tom Ferry is launching a new artificial intelligence (AI)-powered chatbot that is specifically designed for real estate professionals. The firm describes TomAI as a “version of ChatGPT trained on 20+ years proven-effective real estate strategy from hundreds of the industry’s leading coaches and thousands of market-dominating agents.”

Read more

The National Association of Realtors (NAR) can breathe a small sigh of relief. The trade group’s nationwide settlement of the commission lawsuits has passed its first hurdle as Judge Stephen R. Bough, who oversaw the Sitzer/Burnett lawsuit, granted preliminary approval to NAR’s settlement on Tuesday. While the agreement still must

Read more

Rocket Mortgage launched a new artificial intelligence (AI) tool on Tuesday that allows its client experience teams to analyze sentiment, record behavior patterns, transcribe conversations and create tailored experiences during customer interactions. The lender estimates it will save tens of thousands of hours annually. That’s the latest step the mortgage lender has

Read more

Mr. Cooper Group named former Wells Fargo Home Lending executive Ranjit Bhattacharjee and former Piper Sandler analyst Kevin Barker to its leadership team on Tuesday. Bhattacharjee will officially join Mr. Cooper on May 6 as its executive vice president and chief investment officer. He will be responsible for oversight of

Read more

Mortgage rates kept climbing on the back of a string of market-moving news. Notably, Federal Reserve Chair Jerome Powell said last week at the Washington Forum that there will be no rate cuts anytime soon because of the strength of the U.S. economy. As a result, HousingWire’s Mortgage Rates Center

Read more

New-home sales reached a seasonally adjusted annual rate of 693,000 in March, according to data published Tuesday by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development (HUD). This figure represents an 8.8% increase from the revised February rate of 637,000 sales, and it also marks

Read more

Do you remember the last time you received a letter in the mail, in an envelope, that was hand-addressed to you? People remember snail mail simply because we don’t receive much of it. Emails are easily forgotten, end up in the spam folder, or are never opened at all —

Read more

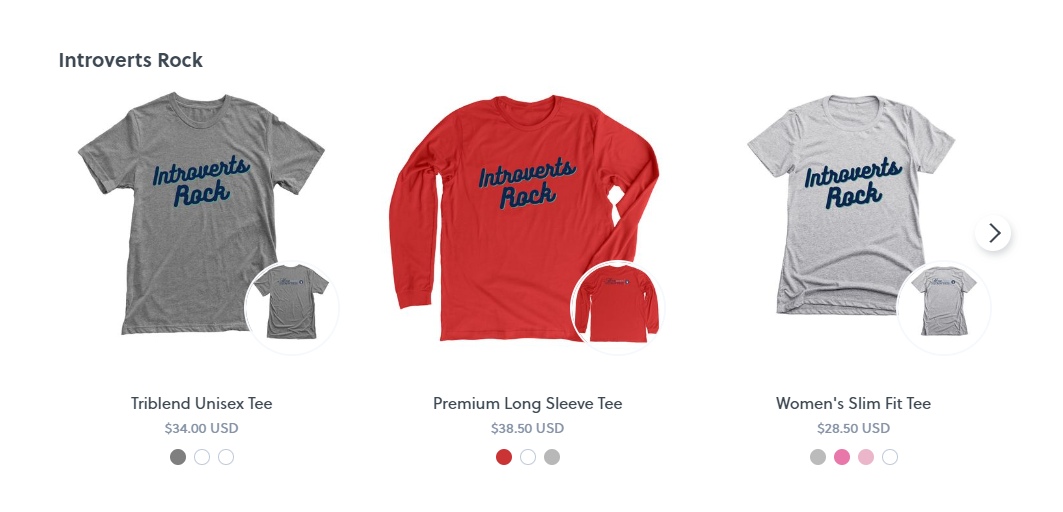

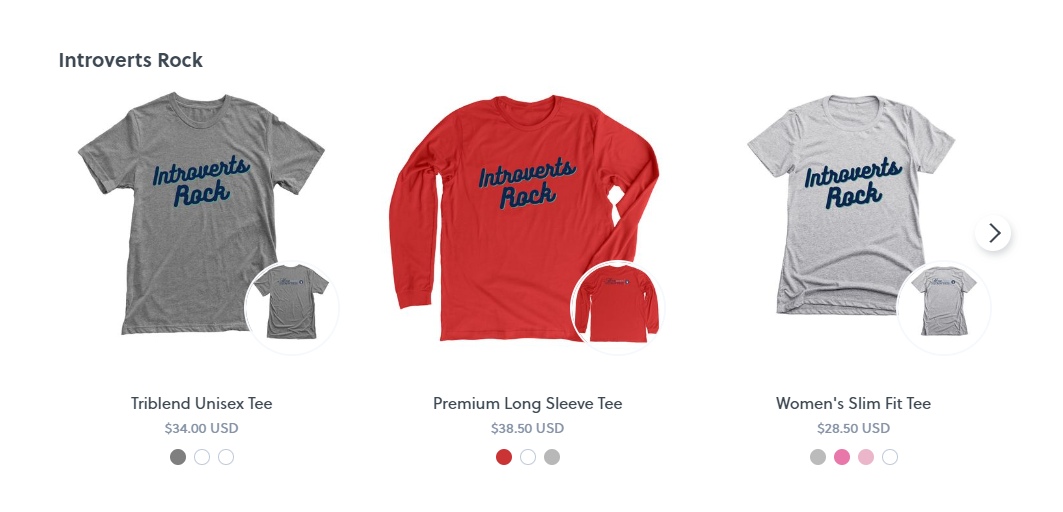

Imagine walking into a room teeming with 200 strangers. Scary, right? As an introverted real estate agent and coach, I know firsthand how challenging networking can be. I started Move Over Extroverts to teach other agents how to face their fears and clear this common hurdle. As introverts, being around

Read more

New York City-based fintech startup Hitch announced the launch of its Hitch Home Equity White Label program in partnership with United Mortgage Corp. This iteration signals Hitch’s smooth transition from the direct-to-consumer market to a collaborative effort with independent mortgage lenders. United Mortgage Corp., a midsized lender based in the

Read more

We’ve researched the best Washington State real estate schools for every budget, schedule, and learning style. From Seattle and Spokane to Redmond and Coastal Washington, our guide will help you choose the best Washington real estate school and course package for your needs. The best real estate classes in Washington

Read more