KBRA Analytics, an affiliate of Kroll Bond Rating Agency (KBRA), has acquired digital-information service Direct Lending Deals, which offers investors and loan originators coverage of deal data, news and analysis in the direct-lending sector. The acquisition will allow KBRA Analytics to offer its customers insights into the fast-growing $1 trillion direct-lending sector. DLD provides analysis,

Read more

With all the talk about a hot housing market and changes on the horizon thanks to increasing mortgage rates, it can be hard to forget that these market-wide changes have a real effect on real people, especially those dealing with loss or health problems in their families. Mortgage Bankers Association’s

Read more

Take a deep dive into these five local housing markets to better understand the trends across the nation. Each city has a unique market and enticing listings to attract new residents. Remote work flexibility opened up the possibilities of where people could live, so more and more homebuyers have decided

Read more

Mortgage POS BeSmartee’s Mortgage Point-of-Sale (POS) platform is a configurable, white labeled solution that streamlines the origination process, including application, credit, PPE, AUS disclosures and appraisal collection and fulfillment. Product Fast Facts #1 Go from application to appraisal in 15 minutes #2 Get to a 91% conversion rate #3 Close

Read more

Solex® Orders Solex Orders is part of the Docutech eClose suite and enables any lender, using any document generation engine, to easily introduce hybrid eClosings as part of their mortgage origination workflow. Simple and fast setup and implementation mean your business can see the benefits of hybrid eClose fast. Product

Read more

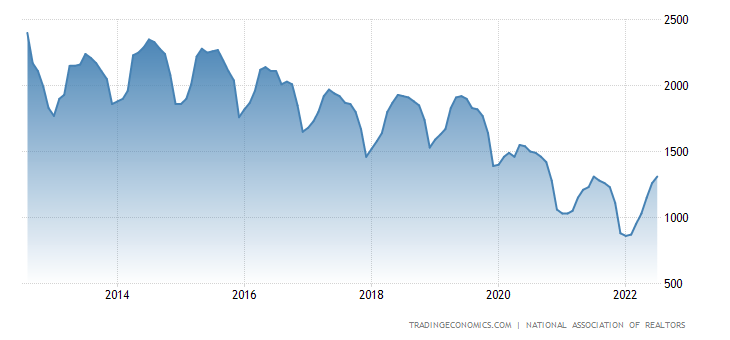

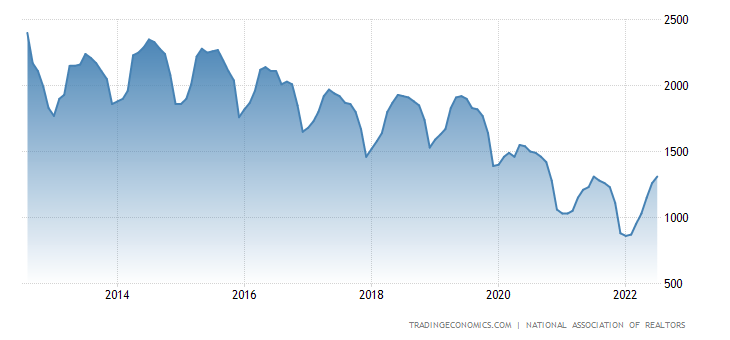

The premise of a mortgage rate lockdown is simple: so many American households have such low mortgage rates that some will never move once rates rise, which then locks up housing inventory. This is something I’ve never believed in because we hadn’t had a period where mortgage rates moved up

Read more

Insellerate’s AgentConnect AgentConnect takes Co-Branded marketing to a new level by automatically delivering dynamic open house flyers, property websites, and landing pages instantly through MLS data in real-time, which is auto-generated and compliantly displayed, including loan officer’s specific loan and pricing options. It has never been easier to add value

Read more

Areal Areal.ai is a no-code automation platform for the lending ecosystem that makes it easy to reliably extract data from complex documents and integrate data with existing tools and workflows. Goal is to provide end to end document automation and integration in order to save our clients resources, time and money

Read more

Inflation is expected to continue “to decline across all horizons” over the next year while home prices, too, are projected to decline “sharply” to the lowest level since July 2020, according to the most recent Survey of Consumer Expectations (SCE) released by the Federal Reserve Bank of New York. The median

Read more

Fraud risk for mortgages declined 7.5% in the second quarter for this year compared to 12 months ago, but income and property fraud incidents are likely to rise, CoreLogic forecasts. In the second quarter of 2022, about 1 in 131 mortgage applications contained fraud while 1 in 120 applications were

Read more

As mortgage interest rates crept back up in August after retreating the previous month, rate lock volume dipped to a four-year low. Total lock volumes were down 8.9% from July, led by a 13.9% decline in rate/term refinance locks, according to Black Knight’s originations market monitor report. Rate/term refi locks

Read more

NEXA Mortgage, the largest mortgage brokerage in the country, this week cut ties with the Association of Independent Mortgage Experts (AIME), claiming the trade group fails to address bullying and lacks proper governance. Mike Kortas, the controversial CEO and co-founder who himself is no stranger to starting online scraps, said

Read more