Mortgage affordability improved in May: MBA

The

median

monthly

payment

for

purchase

mortgage

applicants

decreased

to

$2,219

in

May,

down

1.6%

from

the

prior

month,

according

to

data

released

Thursday

by

the

Mortgage

Bankers

Association

(MBA).

”Homebuyer

affordability

conditions

improved

in

May

as

slightly

lower

mortgage

rates

and

an

uptick

in

housing

inventory

slightly

eased

the

recent

rise

in

application

payment

amounts,”

Edward

Seiler,

MBA’s

associate

vice

president

of

housing

economics,

said

in

a

statement.

“MBA

is

forecasting

for

mortgage

rates

to

fall

closer

to

6.5

percent

by

the

end

of

the

year,

which

along

with

rising

inventory

levels

and

a

subsequent

slowdown

in

home-price

growth,

should

help

affordability.”

At

HousingWire‘s

Mortgage

Rates

Center

on

Thursday,

the

average

rate

for

30-year

conventional

loans

was

7.08%,

down

from

7.26%

at

the

end

of

May.

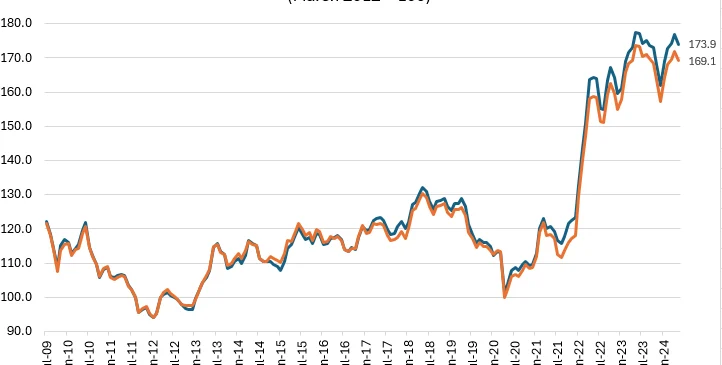

The

national

Purchase

Applications

Payment

Index

(PAPI)

—

benchmarked

at

100

in

March

2012

—

fell

1.6%

in

May

to

a

reading

of

173.9.

The

MBA

noted

that

borrowers

applying

for

”lower-payment

mortgages”

—

up

to

the

25th

percentile

of

payment

amounts

—

saw

their

median

monthly

payment

fall

by

1.9%

to

$1,508

in

May.

For

new-home

purchases,

the

trade

group’s

builder

application

payment

index

showed

a

median

monthly

payment

of

$2,522

in

May,

down

3.2%

from

April.

Across

various

loan

types,

conventional

loan

applicants

had

a

median

monthly

payment

of

$2,226

in

May,

down

from

$2,271

in

April.

For

Federal

Housing

Administration

(FHA)

loan

applicants,

the

median

payment

dropped

from

$1,955

to

$1,924

during

the

month.

At

the

state

level,

the

highest

purchase

application

payment

readings

last

month

were

in

Idaho

(262.9),

Nevada

(258.3),

Arizona

(231.4),

Florida

(221.8)

and

Rhode

Island

(220.2).

The

lowest

readings

were

in

Louisiana

(127.4),

Connecticut (131.4),

New

York

(132.2),

Alaska

(136.8)

and

West

Virginia

(139.3).

This

is

a

measurement

of

payment

growth

since

March

2012.

MBA

also

noted

that

homebuyer

affordability

increased

for

white,

Black

and

Hispanic

households

alike.

Related