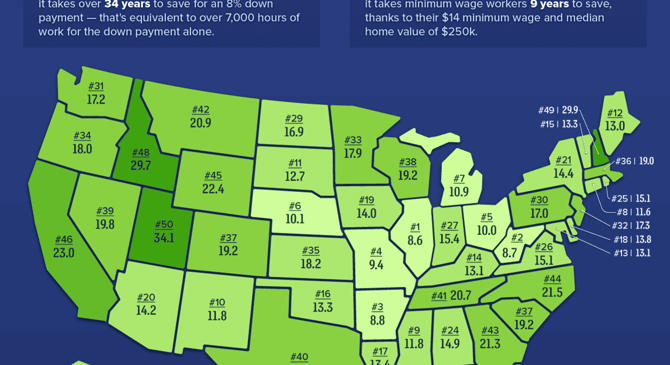

Saving for a down payment can take decades for minimum-wage workers

The

upfront

cost

of

homeownership

can

be

a

difficult

prospect

even

for

households

with

higher

income

levels.

A

study

released

Wednesday

by

personal

finance

website

BadCredit.org

illustrates

that,

in

some

states,

it’s

next

to

impossible

for

minimum-wage

workers.

To

calculate

the

amount

of

time

it

takes

minimum-wage

workers

to

save

for

a

down

payment,

the

company

analyzed

Zillow‘s

median

values

for

single-family

homes

and

condominiums

from

May

2023

through

April

2024.

It

then

correlated

this

data

to

the

minimum

wage

in

each

state,

according

to

the

U.S.

Department

of

Labor.

BadCredit.org

assumed

an

8%

down

payment

—

which

is

the

typical

amount

for

first-time

buyers,

according

to

the

National

Association

of

Realtors

—

along

with

saving

10%

of

total

income

while

working

40

hours

a

week

for

52

weeks

per

year.

The

company

found

that

at

the

national

level,

the

average

minimum-wage

worker

would

need

about

23

years

to

save

for

an

8%

down

payment.

That’s

based

on

the

federal

minimum

wage

of

$7.25

per

hour

and

a

median

home

value

of

$349,000.

courtesy

of

BadCredit.org

“The

findings

are

a

sobering

reminder

of

the

financial

hurdles

that

low-income

earners

face

in

achieving

the

American

Dream

of

homeownership,” Jon

McDonald,

senior

editor

at

BadCredit.org,

said

in

a

news

release.

“While

we’re

seeing

increases

in

minimum

wage,

such

as

the

recent

rise

for California’s fast

food

workers,

these

steps

are

often

insufficient

to

bridge

the

gap

in

high-cost

housing

markets.”

Naturally,

the

timeline

varies

from

state

to

state.

In

Utah,

it

would

take

a

minimum-wage

earner

34.1

years

to

save

for

an

8%

down

payment.

In

10

other

states

—

including

New

Hampshire,

Idaho

and

Hawaii

—

it

takes

at

least

20

years

to

achieve

the

goal.

“If

a

person

(earning

the

minimum

wage)

were

to

save

10%

of

their

income

starting

at

age

18,

they’d

be

ready

to

pony

up

an

8%

down

payment

by

age

41,”

the

report

explained.

Comparatively,

someone

making

the

median

income,

which

is

roughly

$68,000

in

the

U.S.,

could

achieve

the

same

milestone

in just

5.1

years.”

Even

at

the

low

end

of

the

spectrum

for

housing

prices,

it

takes

the

better

part

of

a

decade

for

minimum-wage

earners

to

afford

a

down

payment.

Illinois

was

deemed

the

least

difficult

state

in

this

regard

at

8.6

years,

based

on

a

minimum

wage

of

$14

per

year

and

a

median

home

value

of

$250,979.

West

Virginia,

Arkansas,

Missouri

and

Ohio

were

next

on

the

list

in

terms

of

shortest

timelines.

Related