Ever wonder what goes on behind the scenes as HW Media intentionally builds and creates its events? This letter from the editor series shows the ins and outs of our HW Annual Event in Austin, Texas from Oct. 10-12. To learn more about the event or to register, go here.

Read more

Most borrowers who had a mortgage forbearance in March 2021, including disproportionately impacted borrowers of color, were either current or closed as of March 2023. This is according to data released this week by the Consumer Financial Protection Bureau (CFPB) Office of Research. In the immediate aftermath of the COVID-19

Read more

DocMagic, a provider of loan document generation and eMortgage services, announced this week the integration of its Total eClose platform with Finastra‘s MortgagebotLOS solution. This integration aims to deliver an enhanced customer experience for mortgage borrowers while streamlining the closing process. “We’ve demonstrated the power of Total eClose through our

Read more

Mortgage rates little changed this week as investors assessed Federal Reserve Chairman Jerome Powell’s latest comments on rate hikes. To sum it up: a very strong labor market remains the main driver behind the Fed’s rate setting decisions and more tightening is still to come. The Freddie Mac’s Primary Mortgage Market Survey, which

Read more

loanDepot is accusing its competitor Movement Mortgage of damaging its business by hiring over 25 employees in three months and “effectively crippling” “now-depleted” branches. The poaching lawsuit, filed on June 22 at a federal district court in Delaware, states that South Carolina-based Movement recruited and hired its employees in late 2021 and early

Read more

After holding steady month over month in April, pending home sales were back down again in May, dropping 2.7%, according to data released Thursday by the National Association of Realtors (NAR). Year over year, pending home sales were down 22.2%, a larger decrease than the 20.3% annual drop recorded in April. The NAR’s Pending

Read more

Most mortgage professionals have either started to adopt artificial intelligence (AI) or are at least aware of how it can be adopted to make the loan origination process more efficient. While it will take time to fully implement AI in the mortgage industry, the most practical use of AI in

Read more

Angel Oak Mortgage REIT has issued a $284.5 million non-QM securitization, which the company said marks an “inflection point” in its business. The company said it intends to use the capital to purchase more newly originated, high-coupon loans while continuing to manage liquidity. The securitization will also reduce Angel Oak’s

Read more

California-based real estate investing platform PeerStreet, Inc. and 14 affiliated debtors filed for protection under Chapter 11 of the U.S. Bankruptcy Code in a court in Delaware on Monday, citing a challenging mortgage market and struggles to raise capital with venture capital funds. “Through its bankruptcy filing, PeerStreet will seek to

Read more

Roughly 80% of real estate investors surveyed are selling single-family homes at or above asking price after fully renovating the properties to make them habitable, according to a report from real estate marketplace New Western. “Investor sentiment is positive right now as they haven’t let the macroeconomic environment slow them

Read more

This week, Fannie Mae published a new frequently asked questions (FAQ) document related to RefiNow, the refinancing product announced by the Federal Housing Finance Agency (FHFA) in 2021 that targets low-income borrowers with single-family mortgages backed by the government-sponsored enterprises (GSEs). Fannie Mae explains in the document that RefiNow products

Read more

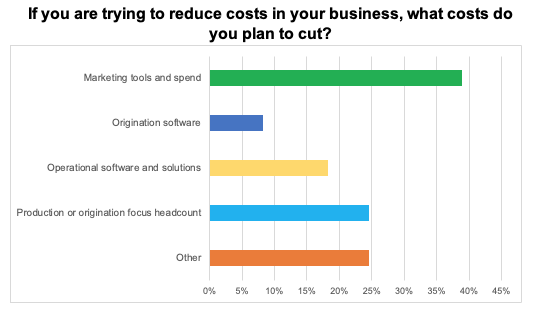

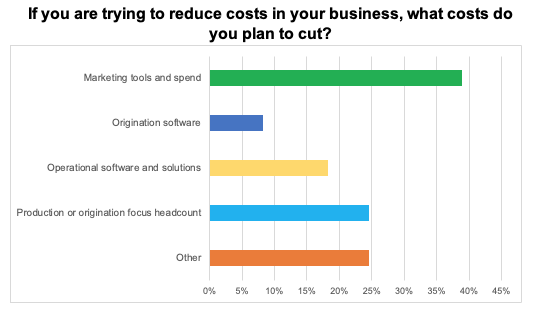

The easy choices have already been made: the low performers left many moons ago, the travel budgets have been slashed, and struggling branches have been sold to competitors or unceremoniously closed. For the mortgage industry, more often it’s about making the very hard choices these days – exiting a channel, deciding which

Read more