Realtors expect these to be the 10 hottest housing markets for the next 3-5 years

On the whole, the nation’s housing prices continued to rise throughout this year and are expected to continue to do so into the foreseeable future.

But, according to the National Association of Realtors, there are a handful of markets that are expected to rise above the rest over the next half-decade or so in terms of performance.

NAR’s economists analyzed the nation’s various markets, comparing various factors and determined which 10 housing markets will be the nation’s hottest over the next three to five years.

To determine the top 10 housing markets that will be the hottest, NAR considered domestic migration, housing affordability for new residents, consistent job growth relative to the national average, population age structure, attractiveness for retirees, and home price appreciation, along with other variables.

According to NAR Chief Economist Lawrence Yun, the top 10 markets are expected to outperform the rest of the nation in a number of those areas.

“Some markets are clearly positioned for exceptional longer-term performance due to their relative housing affordability combined with solid local economic expansion,” Yun said. “Drawing new residents from other states will also further stimulate housing demand in these markets, but this will create upward price pressures as well, especially if demand is not met by increasing supply.”

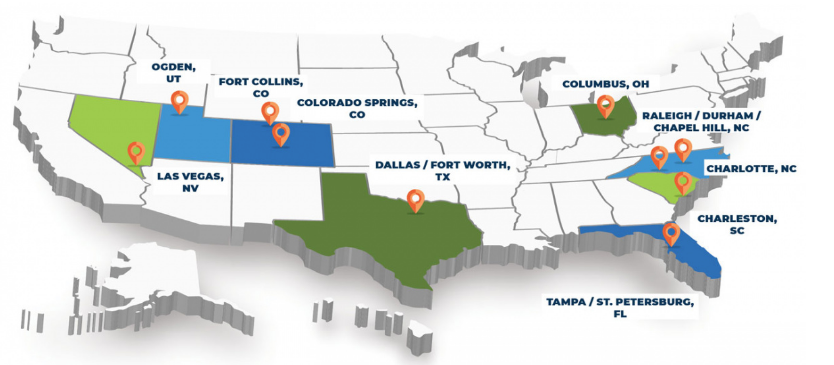

Without further adieu, here are the 10 markets that NAR expects to the hottest in the nation in the next three to five years. In alphabetical order, the markets are:

- Charleston, South Carolina

- Charlotte, North Carolina

- Colorado Springs, Colorado

- Columbus, Ohio

- Dallas-Fort Worth, Texas

- Fort Collins, Colorado

- Las Vegas, Nevada

- Ogden, Utah

- Raleigh-Durham-Chapel Hill, North Carolina

- Tampa-St. Petersburg, Florida

According to NAR, strong job growth is helping to drive up home prices in these markets, with payroll employment rising approximately 2.5% annually in the last three years, higher than the national rate of 1.6%.

Ogden, Las Vegas, Dallas, and Raleigh, all had job growth of nearly 3% in the last three years.

Beyond that, these markets are attracting more new residents than others. More specifically, people are moving to these markets at higher rates than the average of the 100 largest U.S. metro areas.

Click to enlarge. Image courtesy of NAR

In Colorado Springs, recent movers make up 21% of the total population, followed by Fort Collins at 17% and Las Vegas at 16%.

The new residents aren’t limited to one particular age bracket or generation either.

According to NAR, 11% of the people who moved to Tampa were 65 years and older, while 54% of recent movers to Durham were between the ages of 18 and 34.

And those new residents look to be a potential boon to the housing market in those metro areas.

According to NAR’s analysis, about half of recent movers who are renting in these 10 markets can afford to buy a home in their respective markets when compared to the nation’s 100 largest metro areas.

That should lead to increases in homeownership rates in these markets due to the market’s relative affordability.

“Potential buyers in these 10 markets will find conditions especially favorable to purchase a home going into the next decade,” said NAR President Vince Malta. “The dream of owning a home appears even more attainable for those who move to or are currently living in these markets.”