Refinances hit 4-year high in October

How much of a refinance surge is the mortgage business experiencing?

Well, for the first time in more than four years, there were more refinances closed

in a month than purchase loans.

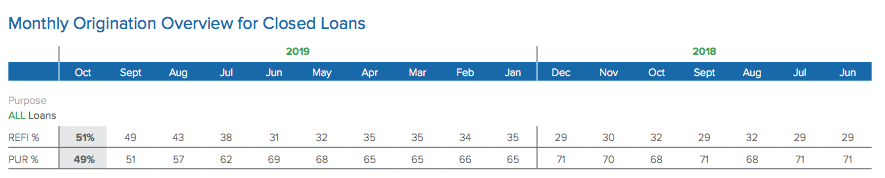

According to the new Origination Insight Report from Ellie Mae, there were more refis than purchase mortgages in October. That’s the first time that’s happened in any month since March 2015.

The Ellie Mae report shows that the refinance share of overall closed loans rose to 51% in October, continuing a trend that stretches back to June.

In every month since June, the refinance share of mortgages

has risen, culminating in there being more refis than purchases in October. The

refi share hasn’t been that high in more than four years.

The increase in refis over the last few months came as a result of a drop in mortgage rates, with the most recent data from Freddie Mac showing that mortgage rates are still more than a full percentage point lower than they were last year.

That shows in Ellie Mae’s data, too. According to the report, the average 30-year mortgage rate for closed loans in October was 3.94%, down from 5.01% in the same month last year.

As a result of that decline, refis have gone up, increasing from

just 31% of total originations in June up to 51% in October.

“Interest rates continued to decline in October which had

homeowners reaching out to lenders as they look to save on their monthly

mortgage payments,” said Jonathan Corr, president and CEO of Ellie Mae. “We are

seeing refinances surpass 50% of closed loans, which is proof that homeowners

are taking advantage of the opportunity to lock in lower rates.”

The post Refinances hit 4-year high in October appeared first on HousingWire.