Fannie Mae and Freddie Mac announced Thursday the appointment of Anthony Renzi as the new CEO of Common Securitization Solutions, the joint venture between the two companies that developed and implemented the single security. In this new role, Renzi will assume responsibility for the platform that supports the administration of

Read more

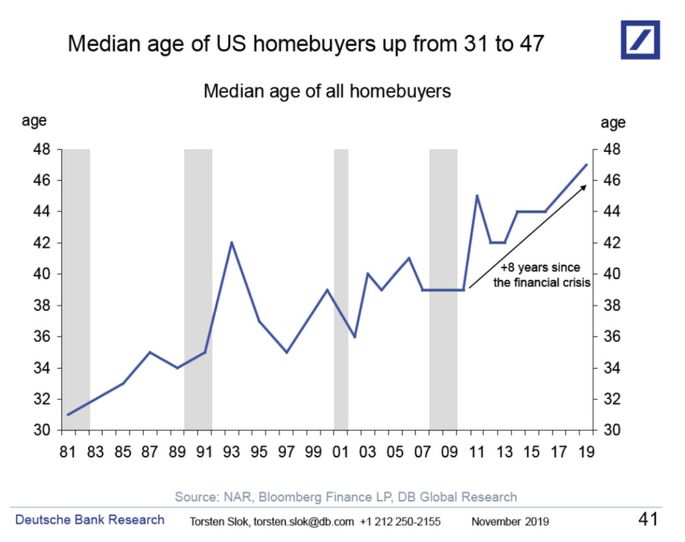

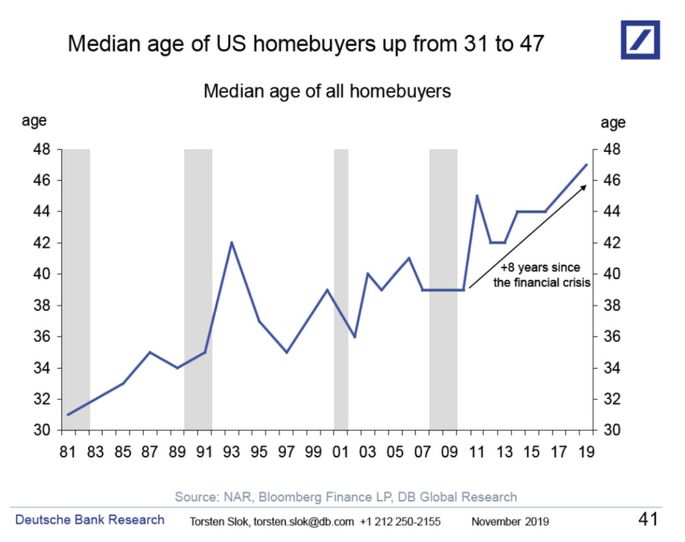

Despite recent data that younger generations are beginning to buy houses, on the whole, those same generations are waiting far longer than their parents did to buy their first house. There are various reasons for that delay, including a dramatic increase in student loan debt and a general shifting of

Read more

If there’s one thing that Mike Cagney specializes in, it’s quickly building billion-dollar companies. He did at SoFi, before leaving the company in 2017 after reports emerged about the alleged toxic culture at the online lender. And now he’s done it again with Figure Technologies, the blockchain lending startup Cagney helped found just last

Read more

The affordability crisis is going strong and only continues to worsen as the housing stock is unable to keep up with the rising demand. The U.S. Department of Housing and Urban Development announced it will invest $10 million to develop 538 affordable homes. HUD announced that in an effort to

Read more

The U.S. unemployment rate fell to another 50-year low, coming in at 3.5% in November as the economy added 266,000 jobs after October’s upwardly revised 156,000 jobs, according to the Bureau of Labor Statistics. The number of unemployed persons changed little, with 5.8 million out of work, according to the report. Comparing

Read more

For the generation that is waiting the longest to buy a home, they appear to be the pickiest too. According to a new data set from the National Association of Home Builders, Millennials care just as much (if not more) about they want in a house rather than what they

Read more

As we move toward the new year, many experts and economists are forecasting the housing market will continue to see growth. Now, one expert looks at the technology advancements we will see in 2020. HousingWire sat down with Steve Butler, AI Foundry president and founder, who gave five trends to

Read more

Mortgage Tech Rundown looks at the latest news in mortgage technology, featuring new product updates, integrations and announcements. Tech-enabled home insurance provider Openly launched on Tuesday, equipped with $7.6 million from its seed round of funding. The company said in a press release it aims to simplify the home insurance buying process

Read more

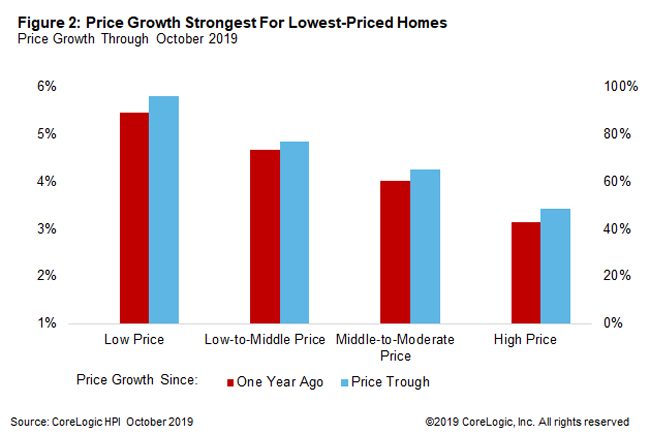

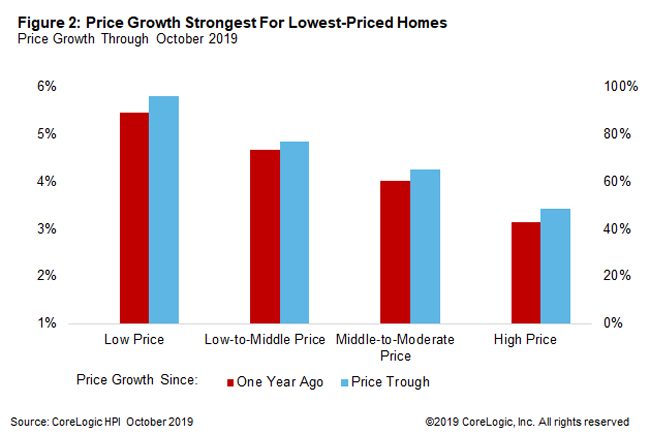

Nationally, home prices increased 3.5% year over year in October, according to CoreLogic‘s latest Home Price Index Report. To be more specific, prices rose on lower-priced homes. A big trend seen in the 2019 housing market saw was tight inventory of both single-family and multifamily, creating a increase in prices.

Read more

It became easier to get a mortgage in November, according to data published Thursday by Mortgage Bankers Association. The group’s Mortgage Credit Availability Index rose 2.1% to 188.9 last month, indicating a loosening of credit standards. It was close to the 11-year high of 189.5 in June, according to MBA.

Read more

Throughout this year, HomeStreet Bank shifted away from the mortgage business, selling off much of its retail mortgage origination business, along with nearly all of the mortgage servicing rights associated with the loans originated in those retail outlets. That move included selling a sizable piece of its origination business to Homebridge Financial

Read more

Just as it did with forward mortgages, the Federal Housing Administration is increasing its maximum claim amount for reverse mortgages for 2020. According to the FHA, the HECM limit will increase in 2020 to $765,600 from 2019’s level of $726,525. This marks the fourth straight year that the FHA has

Read more