Renovate-to-rent fueling sustained demand at foreclosure auction

Slowing home price appreciation has eroded

potential fix-and-flip profits over the past year, but demand at

foreclosure auctions has remained strong as buyers shift to a renovate-to-rent

strategy.

“Last year we actually bought two properties on Auction.com.

One we were able to fix and flip it, and one, due to the market, we held on to

it as a rental,” said Ty Stanley, a real estate investor who operates Real Home Solutions Ltd. Co.,

buying properties in South Florida and across the state. “The market was just

flooded, and it was more so a buyer’s market. We were not able to hit the

numbers we were looking for, so rather than sell it below market we held on to

it as a rental.”

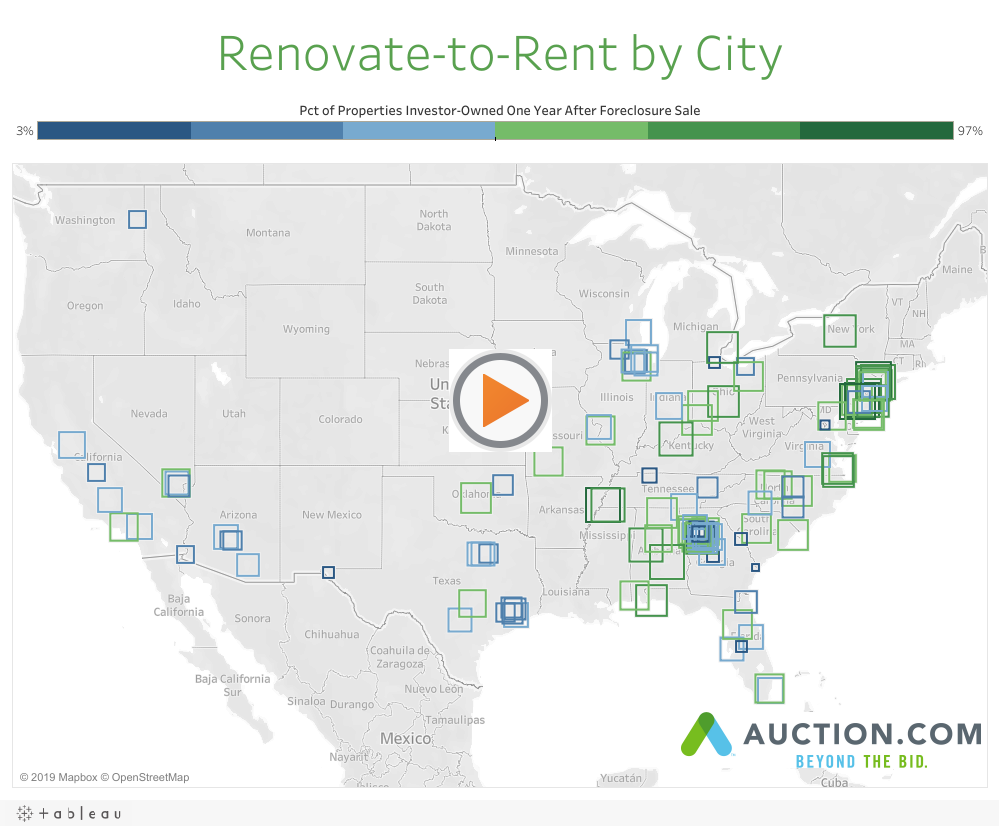

Stanley’s experience is similar to that of many buyers using Auction.com, according to an analysis of more than 9,000 properties sold at foreclosure auction via the Auction.com platform in Q2 2018. While the majority of these purchases (56%) were rehabbed and resold to owner-occupants, 44% were still non-owner-occupied a year later, indicating they were being held as rentals.

Favorable market conditions

Stanley said that rental property is cash-flowing thanks in

part to changing market conditions that make renovate-to-rent more attractive.

The U.S. homeownership rate dropped for the second consecutive quarter in Q2

2019, following 10 consecutive quarters with increasing or flat homeownership

rates, according to the U.S. Census

Bureau.

A lower homeownership rate translates into more demand from

renters, which places upward pressure on rental rates and downward pressure on

vacancies, both favorable trends for rental property owners. The U.S. rental

vacancy rate dropped to 6.8% in Q2 2019, down from 7.0% in the previous quarter

and unchanged from a year ago, according to the Census data.

Those same market conditions are helping to fuel what CNBC

recently called an “exploding” build-to-rent market.

“We are becoming more of a rentership society than a

homeownership society, and that is playing into the build-to-rent model,” said

Bruce McNeilage, co-founder and CEO of Kinloch

Partners, which is doing build-to-rent projects in five markets across the

Southeast: Nashville, Atlanta, Raleigh, North Carolina, and

Greenville-Spartanburg and Columbia in South Carolina. “We’re primarily focused

in on doing entire subdivisions … self-contained subdivisions with their own

homeowners’ association.”

According to the Census bureau, 43,000 homes were built as

rentals in 2018, up 16% from 2017 and representing about 5% of all new homes

built for the year.

Renovate-to-rent up 9%

in 2018

Even by conservative estimates, the renovate-to-rent market

is much larger than build-to-rent, according to an Auction.com analysis of

public record data from ATTOM Data Solutions. More than 1.1 million single

family homes and condos (1,163,184) were sold to cash buyers in 2018,

representing 26% of all existing home sales during the year. While not all of

those cash buyers are investors, the vast majority are likely investors either

buying the home as a rental or to flip.

The analysis shows that 242,356 homes were flipped — sold for the second time in 12 months — in 2018; however, 53,676 of those flipped homes were re-sold to cash buyers, likely investors holding the properties as rentals. That results in roughly 974,000 properties purchased by rental investors in 2018. Using the same methodology for 2017, the number lands just north of 888,000, implying a 10% increase in purchases by rental investors in 2018 compared to 2017.

36% of auction buyers

prefer renovate-to-rent

More than one in three buyers (36%) purchasing at

foreclosure auction or bank-owned (REO) auction said hold-for-rent is their

most preferred investing strategy, according a June

2019 survey of buyers who have purchased multiple properties on the

Auction.com platform.

Similarly, an analysis of more than 9,000 properties sold at

foreclosure auction via the Auction.com platform in Q2 2018 shows that 44% were

non-owner-occupied a year later, in July 2019. That non-owner occupancy status a

year later indicates the properties are being held as rentals.

The analysis also looked at an estimated rental yields —

based on an automated rental valuation model provided by Collateral Analytics —

for those 9,000 properties. As evidence that investors are picking the optimal

investing strategy, the average potential gross rental yield for the 44% of

properties still investor-owned a year later was higher than it was for the 56%

of properties that were owner-occupied a year later — 11.7% for the investor owned versus 10.5% for

the owner-occupied.

Renovate-to-rent investors

bid higher at auction

The higher potential gross rental yield for investor-owned

properties was not based on investors getting a better deal at foreclosure

auction. In fact, the average winning bid-to-credit bid ratio for the 44% of properties

held as rentals was higher at 116.2% compared to 115.1% for properties that

were subsequently sold to owner-occupants after being purchased at foreclosure

auction.

“Lenders are confronted with a classic cost-benefit decision

at the foreclosure auction, and the credit bid is typically the reserve price over

which the benefit of selling at foreclosure auction outweighs the opportunity

cost — the benefit lenders would get from taking back the property and

reselling or holding as a rental,” said Jesse Roth, SVP of Strategic

Partnerships and Business Development at Auction.com. “The slightly higher

ratio of price-to-credit bid for properties held as rentals means that sellers

at foreclosure auction continue to benefit from a consistent pool of buyers

willing to pay above the reserve price even as the housing market shifts toward

one that is more favorable to rental investing.”

Renovate-to-rent investors likely have a higher price

ceiling than fix-and-flip investors in the 2019 market because their potential

returns hinge on rental rates — which continue to increase steadily in most

areas of the country given the aforementioned market conditions — while

fix-and-flip returns are more dependent on home price appreciation, which has begun

to slow in an increasing number of local markets.

“If I was going to flip the property I might be able to pay 80 (thousand) for it, but if it was a rental I might be able to pay 90k,” said Paul Lizell, a Philadelphia-area real estate investor who said he is focused on picking up more rentals in 2019.

var divElement = document.getElementById(‘viz1574178219867’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’1000px’;vizElement.style.height=’827px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

The post Renovate-to-rent fueling sustained demand at foreclosure auction appeared first on HousingWire.