Homebuilder confidence slightly fell this month thanks to labor and supply concerns, according to January’s Housing Market Index. The National Association of Home Builders and Wells Fargo, which publish the monthly report, revealed sentiment slipped by one point to 75. “With the Federal Reserve on pause and attractive mortgage rates, the steady rise in single-family construction

Read more

Top-producing loan officers have an outsized impact on a lender’s bottom line, but companies who want to compete for talent at this level need to understand what factors are in play for attracting these LOs and what will keep them happy in the long term. That’s why we’re excited to

Read more

This week, the average U.S. fixed rate for a 30-year mortgage averaged 3.65%. While this percentage is slightly above the previous week’s average, it’s still 80 basis points below the 4.45% of the same week last year, according to the Freddie Mac Primary Mortgage Market Survey. “Mortgage rates inched up by one basis point this

Read more

Zillow CEO Rich Barton is the most powerful person in real estate this year, according to the Swanepoel Power 200, an annual ranking by consultants at T3 Sixty. Barton co-founded Zillow in 2005 and served as its original CEO before stepping aside five years later to let co-founder Spencer Rascoff

Read more

NerdWallet has announced the winners of its 2020 Best Mortgage Lenders list, which ranks the nation’s top mortgage lenders by their ability to best assist homebuyers with their financial decisions while purchasing a home. The company reviewed the majority of the largest U.S. mortgage lenders by annual loan volume, ranking those

Read more

Real estate technology company Reali announced Wednesday that it has made an update to its app, and now claims that the app is the “first in the real estate industry – and the app is the only one of its kind” that services homebuyers and sellers in a single app.

Read more

Conventional wisdom says the Federal Reserve won’t cut rates during an election year, to avoid looking like it’s favoring one candidate over another – unless there’s an economic shock so severe, it’s forced to act. However, we don’t live in conventional times. UBS, one of the world’s biggest investment banks,

Read more

Consumers today are accustomed to personalized experiences across the board – even in advertising – and mortgage lenders need to keep pace with those expectations to gain business. By applying proprietary technology to the same data used by all mortgage lenders for direct mail marketing, Monster Lead Group helps its

Read more

Mortgage applications spiked 30.2% from last week, according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey. This means on a seasonally adjusted basis, the index grew by 30.2% for the week ending on Jan. 10, 2020. On an unadjusted basis, the index rose 67% compared to the previous week. Joel Kan,

Read more

Digital lending platform Blue Sage announced it has hired David Aach as its new, and first, chief operating officer. Prior to joining Blue Sage, Aach was the executive vice president of mortgage tech company Docutech, where he helped the company more than double its revenue. Before Docutech, Aach worked at

Read more

We’re not even halfway through January and it has already been a crazy year. In these turbulent times with threats of war and recession as well as looming elections, many have speculated as to what headline risks would negatively impact the overall economy, thus affecting mortgage rates. For a deeper

Read more

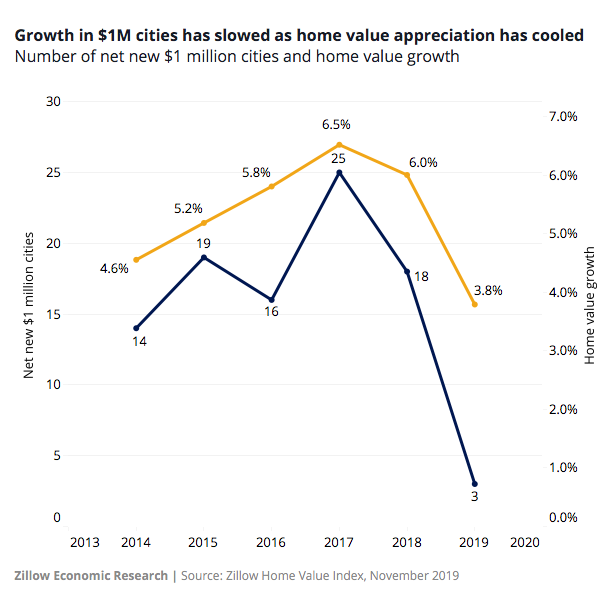

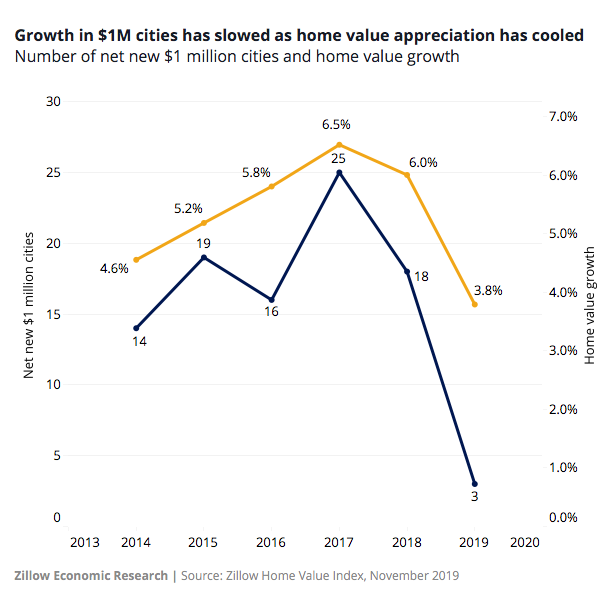

The luxury real estate market had a bumpy 2019, but ended in a steady rise in luxury home prices. In the first quarter of 2019, luxury home prices declined for the first time in almost three years, and sales saw their largest decline since 2010 as supply increased by double

Read more